So you are buying a home?

We are currently in the process of buying a home. Actually, this is the 6th home we’ve bought in the past 13 years – so I’ve been through the wringer a few times. Combine that with my past life of being a mortgage lender, and coaching others on buying their first (or second, or third) homes for the past 5 years, I have a lot to share with you today!

I often have fun conversations with clients around these 6 common home buying mistakes, so I figured I would share them with you today!

Home Buying Mistake 1: Following the 28% Rule of Dumb

This rule states you shouldn’t spend more than 28% of your gross income (what you take home before taxes) on your mortgage payment (principal and interest only). The 28% number is also called the front-end ratio.

Example: If your household gross monthly income is $10,000, then you can afford to spend around $2,800 on your mortgage principal and interest per month. (10,000 * .28 = 2,800)

Coach’s Note: I feel the 28% rule is a rule of dumb. As a past mortgage lender and a financial coach, I have seen countless clients over-extend themselves because they don’t #knowyournumbers.

Hear me out, this doesn’t take into consideration any other large monthly payments you might have. For example, I’m currently paying $2,300 in child care monthly and $1,200 for self-employed medical insurance.

The Math (based on our example above):

$10,000 (gross income) – $2,800 (mortgage) – $2,300 (child care) – $1,200 (insurance) = Remaining $3,700 😵💫

The list of monthly expenses go on and on.

You should look at those and any other significant debt payments you have. You must understand your cash flow and the actual payment amount you can afford.

Bottom line: Just because your lender says, you can afford a $450,000 home doesn’t mean you should. P.S. The bigger the home and loan, the bigger the commission a realtor or mortgage lender will make.

Home Buying Mistake 2: Purchasing on future or hopeful income. #knowyournumbers

Being house poor is a real thing. It’s heartbreaking as a coach when helping clients put a financial system in place to find out that their home costs are costing them almost a full paycheck. When it comes to your appetite for borrowing, don’t go into the home buying process with your eyes bigger than your stomach.

Coach’s Note: Never grow into a payment. Do not count future income growth, overtime, or extra income from a side hustle.

Home Buying Mistake 3: Wiping out all your cash to buy your home.

I know this is tempting! You found your dream home and nothing will stop you from making it your own. The home buying process is highly emotional.

True Story: Clients of mine were on day three of their newly purchased home and their hot water heater fizzled out. How disappointing, right? But also… how scary if you just put every dollar to your name to buy your dream home, the costs of moving, expenses of making your house and home, and now this!? Don’t put yourself in this situation!

Coach’s Note: Before you start shopping for a home, know exactly how much is dedicated to your emergency funds and do not use it. Start this conversation before you get emotionally attached.

Home Buying Mistake 4: Not talking to Real Estate professionals early in the progress

There are many things to do to get ready to buy a home. Talking to a mortgage lender and real estate agent is one of them. But when is the right time to start that connection?

The answer may depend a bit on your personal case, but the short answer is that it’s never too early to talk to both a mortgage lender and a real estate agent. I’d personally, start with a mortgage lender because even if you don’t end up buying a house for 18-30 months, your mindset will be different from the knowledge that you gained and a bit of clarity on what you need to do next.

Coach’s Note: As a previous mortgage lender, or any suitable lender, the goal is to help you get “mortgage-ready.” This means getting you and your finances to qualify for the best mortgage possible, with financial terms and a monthly payment that makes sense for you and your budget. They will also encourage you to make sure your credit is in order. If you find any issues, resolve them immediately.

Home Buying Mistake 5: Only getting one quote on your mortgage

Speaking of real estate professionals, in order to be a smart shopper when it comes to getting your mortgage, it’s a good idea to get a minimum of three quotes from different financial institutions.

This one mistake could cost you big time. Additionally, getting multiple quotes can enable you to see if there are many variations in the rates and terms you are being presented with.

Example: I’m closing on a home and my rates varied by 1% from one lender to the next.

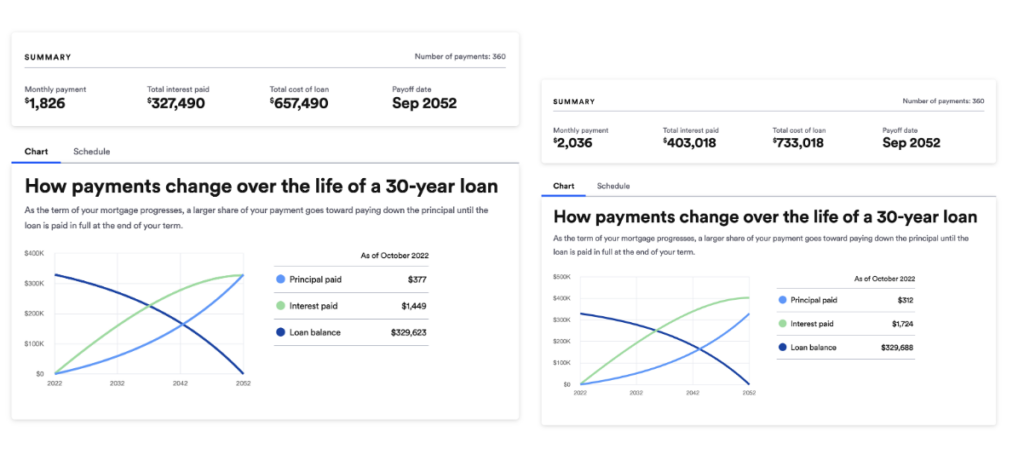

Let’s consider a loan amount of $330,000, 30-year loan, 5.27% vs 6.27%. See below for details but in this case, that is a savings of over $75k. This is mind blowing. 😳

Home Buying Mistake 6: Looking at homes above your pre-approval price

This one is simple but emotional. Don’t do it.

Of course, you want to see homes that look all sexy in the photos. But if you can’t afford that home, you set yourself up for disappointment. You’ll get stuck with this one home in your head and all homes moving forward will feel lack lust or incomplete.

Save yourself emotional heartbreak and time by looking at home in the right rage that you can actually afford instead of falling in love with a home that is out of reach.

THE BOTTOM LINE:

Buying a home is exciting, exhausting and an emotional roller coaster. Knowing your numbers and having confidence around your money will help you feel more in control of the process.

If buying a home is on your list, reach out to me. I can help you get there!

Meet MicKallyn

Hi, I’m Mickallyn, a Mortgage Lender/Banker turned Financial Coach. When student loans put me in debt, I knew I didn’t want to live the rest of my life paying them off, so I figured out how to pay them all off in just a year. Now I have zero debt, 3 homes, 4 college degrees and am raising two little boys. I’ve traveled to over 22 countries and live a debt free life. I’m committed to helping others do the same through 1 on 1 coaching and personalized plans that actually work.