Investing is something that many of my clients feel uncomfortable with.

So today I wanted to spend some time busting 💀 some common myths that people hold about investing so we can take away the mystery and get you comfortable with the idea of investing.

Myth Busting: Investment Edition

Myth: I don’t have much to invest, so it is simply not worth it.

Fact: It doesn’t matter how modest your funds are; you must start the habit of saving as soon as possible.

This is the idea behind paying yourself first. A great place to start is your company 401k or an IRA.

Myth: I don’t know enough about investing to get started.

Fact: There are many ways to invest in the stock market, but robo-advisors like Wealthfront and Betterment make it easy to get started.

Most of them will ask you to fill out a profile to tailor your holding based on factors like investment goals, risk tolerance, and age. Plus, robo-advisors can require as little as $10 to open an account. Compare the options on Nerdwallet.com.

Myth: Only those with a lot of money can make money.

Fact: It doesn’t matter what you make; it matters what you save.

There is a common misconception that only those with a lot of money can invest and get a nice return. I’m going to be real here! It doesn’t matter what you make; it matters what you save. No more excuses, my friend. You will make money by starting to keep disciplined saving and investing habits for decades to come.

Myth: Invest over time rather than all at once.

Fact: According to a study by Vanguard, they compared lump-sum investing vs. dollar-cost averaging and found that in the long term, the sooner you invest, the more money you make.

The best time to start investing is right now. No matter the amount, the sooner, the better.

Myth: You need to be debt-free to start investing.

Fact: You’ll hear me preaching all the time about how everyone should prioritize investing. Especially in this raging bull market. 🔥📈

However, there I have one exception…if you’re buried in high-interest debt (anything over 6% in my option) you need to prioritize paying off that debt more than investing.

Should you invest first or pay off debt first?

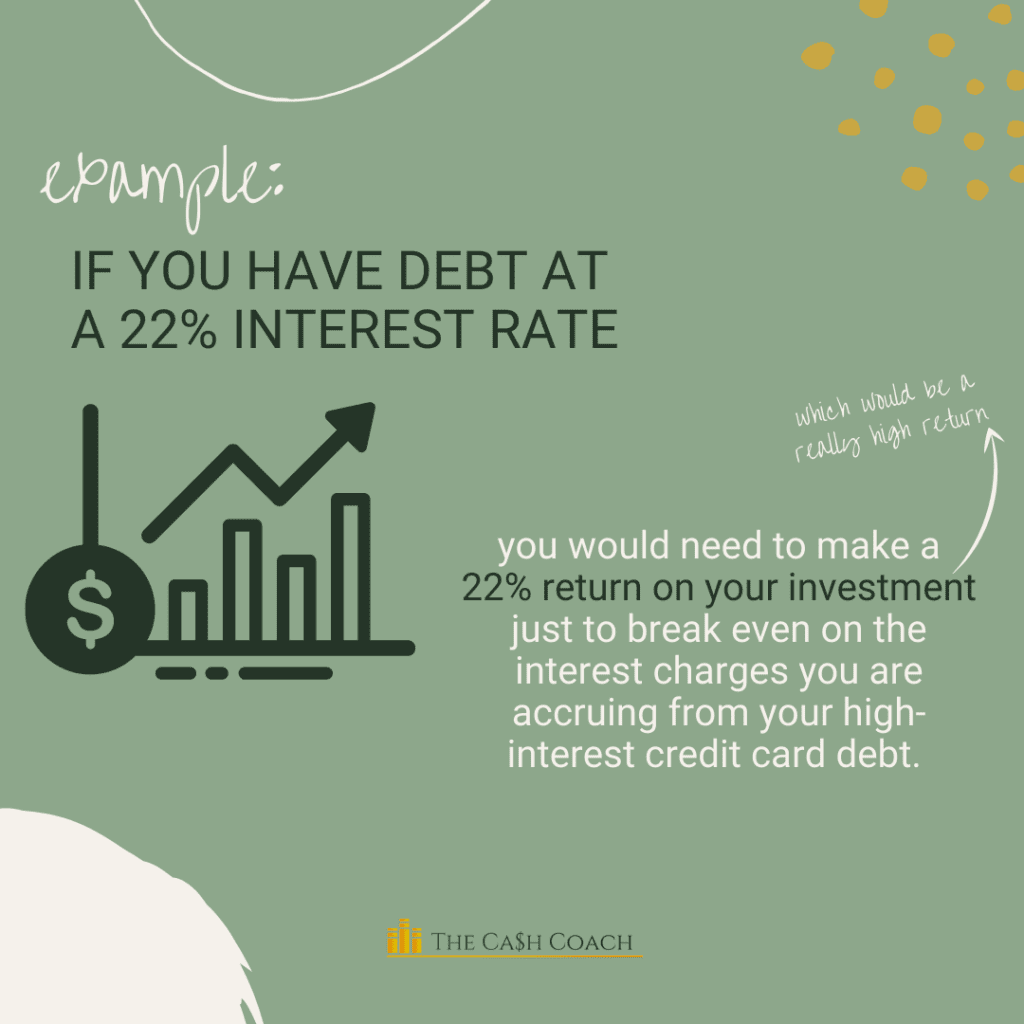

If you’re carrying credit card debt at a 22% interest rate, and you choose to invest the money into the stock market instead of paying off your debt, then you’d essentially need a 22% return on your investment just to break even on the interest you are accruing on your debt.

For those who do not have high-interest debt, time in the market matters more than how much money you invest each month. What matters is that you’re starting as soon as you’re able to.

If you aren’t sure where to start or what the next right move is for you – consider setting up a Discovery Call with me.

One of my clients recently told me she feels like she is driving with headlights on now and I love that because that’s exactly what I feel like I am here for; to help you navigate the dark so it’s not so scary.

Let’s make you money,

Coach MicKallyn

Disclaimer: This is education and should not be looked at as investment or financial advice. Always learn what’s best for you.

Meet MicKallyn

Hi, I’m Mickallyn, a Mortgage Lender/Banker turned Financial Coach. When student loans put me in debt, I knew I didn’t want to live the rest of my life paying them off, so I figured out how to pay them all off in just a year. Now I have zero debt, 3 homes, 4 college degrees and am raising two little boys. I’ve traveled to over 22 countries and live a debt free life. I’m committed to helping others do the same through 1 on 1 coaching and personalized plans that actually work.