Hold tight…. It’s not what you think. I’m not here to lecture on what an emergency fund is or why you need one.

I like to think of myself as a “cool mom,” and “cool moms” don’t talk about the same s*** you can go read on 100k plus other blog posts.

(Cool Mom Status –>)

So let’s dive in!

Here are the main 5 questions I’m asked around emergency funds:

Where should I keep my emergency fund savings?

Emergency savings are best placed in an interest-earning bank account, such as a high-yield savings account (HYS) or money market, that can be accessed easily without taxes or penalties. The concern with placing your emergency savings in mutual funds, stocks, or other assets is that they may lose value if the fund needs to be accessed quickly.

Here are the top three no fee and no minimum deposit required financial institutions my clients love for savings accounts.

- You can personalize your Ally saving account with nicknames, savings buckets, goals, and automation.

- Learn how to take advantage of my favorite feature that Ally’s Savings account offers: 5 Ways to Hit your Goals using savings buckets

2. Capital One: 360 Performance Savings

- You can also personalize your accounts.

- You can pay your Capital One credit card directly from these savings accounts.

- They offer fantastic customer service. So many great products and services to choose from.

When can I use my ermergency funds?

Occasional-but-Predictable Expenses Aren’t Emergencies

Sometimes it’s hard to know when to use your emergency fund; unexpected expenses can always feel urgent to some degree. But if we use our emergency fund every time we have something unexpected pop-up, it will quickly be empty.

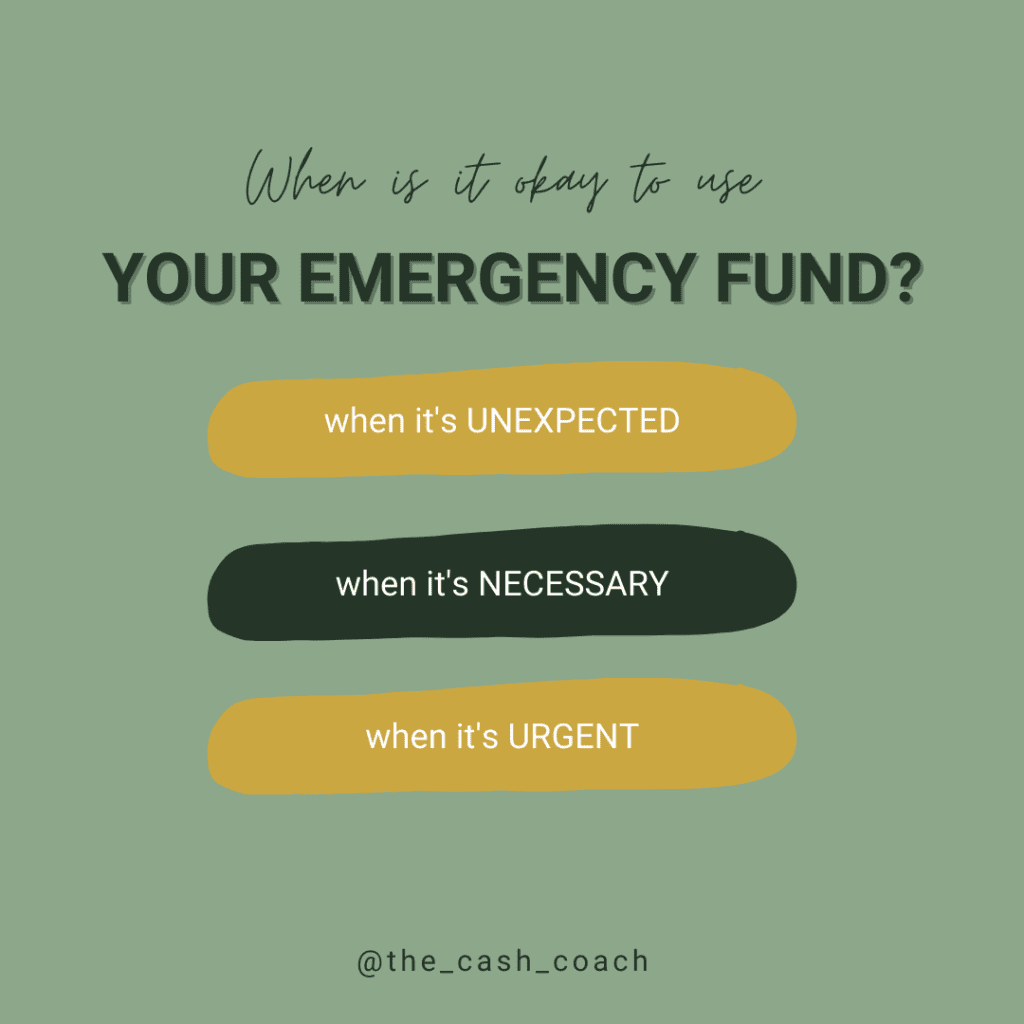

That’s why I created the “All Three = Feel Free” rule for my clients.

If your need is

- UNEXPECTED (not planned for),

- NECESSARY (do you absolutely need to do it?), and also

- URGENT (can it wait?), then it is a true emergency and you should feel free to use your emergency fund towards it.

This often looks like a medical emergency, major car repair after an accident, unexpected essential travel, a sudden loss of a job … or a global pandemic. #toosoon?

If it doesn’t hit all three, it’s something you should use a Savings Bucket for.

Let’s take car repairs as an example:

- You know you’ll have to pay for major car repairs at some point, but you don’t know when this will happen. For example, your car may break down this year, or it might not break down for another three years.

- However, you do know that at some point, you’ll have to put money into fixing your car.

- This is an expense that’s predictable in nature but not in timing.

- Therefore, it is NOT an emergency fund expense.

The same is true for replacing your car altogether. And almost any other major appliance; washing machine, water heater, air conditioner, dishwasher, and the leaking roof on your house. You don’t know WHEN these will happen, but you know; eventually, they will. These events are predictable, but the timing is not.

Ideally, you should NOT use your emergency funds to pay for these types of expenses. Instead, you should set aside a little bit of money each month that allows you to pay for these repairs and maintenance issues when they arise.

To learn more about saving and getting organized for occasional but predictable expenses, click here.

How Much Should You Save in your Emergency Fund?

There’s no one right answer to the question of how much you should save for an emergency. I know this isn’t what you want to hear, but no two situations are exactly the same.

While each person’s situation is unique, I can tell you that every household should have a minimum of three months worth of expenses saved.

Here are some additional guidelines you can use to determine how many months of expenses you need to save for.

- Are you the sole breadwinner for your family?

- How regular is your paycheck?

- Are you in a high-risk industry where layoffs are common?

- Is your income unsteady?

- Do you or your family have serious health issues?

- Do you have a growing family?

- Is there a significant life event happening within the next 12 months?

- What is your risk tolerance?

If you want help figuring out how much you should have saved in your emergency fund, set up a Discovery Call with me & we will access your exact situation. in your E

Is it better to save for your emergency fund or save for retirement?

Retirement savings and saving for an emergency are both essential financial priorities.

You definitely need to start saving for retirement as soon as possible if you don’t want to be broke as a senior. Additionally, it’s much harder to save enough if you start saving late because you spent years working on building an emergency fund.

If you have a 401k at work and your employer matches your contributions, you typically should contribute as much as you need to earn the maximum match. There’s no reason to miss out on free money. However, if your job is unstable, you have serious health issues, or you’re at elevated risk for an emergency for some other reason, prioritizing your emergency fund might make sense.

If your employer doesn’t offer a match, then it’s a judgment call whether to devote all your spare cash to saving for an emergency fund or allocate some of your money to retirement savings too.

This is another area that I can help you analyze in a Power Plan session.

Should you save for your emergency fund or pay down debt?

An emergency fund is intended to help you stay out of debt, but what if you’re already in debt

Deciding whether to save up an emergency fund or focus aggressively on paying down debt is difficult. Your lender likely charges a much higher interest rate than you’ll earn on your emergency fund, so it may seem silly to have money sitting in the bank while you pay interest.

However, it makes sense to save for an emergency fund in almost every case before beginning an aggressive plan to pay down debt. This never means skipping minimum payments — you always need to pay the minimums. However, unless you have very high-interest consumer debt, like payday loans or a credit card with a penalty interest rate, it makes sense to save for an emergency first.

While the math may point you in the other direction, the problem comes when that inevitable emergency strikes. If you’ve been sending all your extra cash to your credit card and your transmission breaks or you lose your job, you may find yourself charging another $2,000 on a credit card that you just paid off. That is beyond frustrating.

This can make you so discouraged that you stop taking steps to improve your finances. But, unfortunately, you could also become trapped in the never-ending cycle of paying down debt and then ratcheting it back up when an unexpected expense arises.

I leave you with these two final thoughts:

- Think of funding your emergency fund as purchasing security. Stop worrying about how much you’re making in interest and focus on the value of “peace of mind.”

- Everyone’s financial situation is unique – and that’s why I do what I do. So if you have questions about your emergency fund, retirement or debt, set up a call with me and let’s make a personalized plan to set you on the right path.

Want more fun financial insights delivered to your inbox?

Meet MicKallyn

Hi, I’m MicKalyn, a Mortgage Lender/Banker turned Financial Coach. When student loans put me in debt, I know I didn’t want to live the rest of my life paying them off, so I figured out how to pay them all off in just a year. Now I have zero debt, 3 homes, 4 college degrees and raising two little boys. I’ve traveled to over 22 countries and live a debt-free life. I’m committed to helping others do the same through 1-on-1 private coaching.