One of the largest regular costs we all see each month is our grocery bill. Which is why I often talk with clients about how to save on their groceries. So today I want to share with you how you can begin meal planning for the week, even if you are short on time – and start saving money in the food department.

Planning meals in advance can seem intimidating. But it doesn’t have to be. Arm yourself with these easy tips and you’ll be scheduling meals and saving money on your grocery bill like a pro in no time at all.

It all starts with your weekly routine….let me show you:

How to start meal planning like a boss so you can save big on your grocery bill 💪

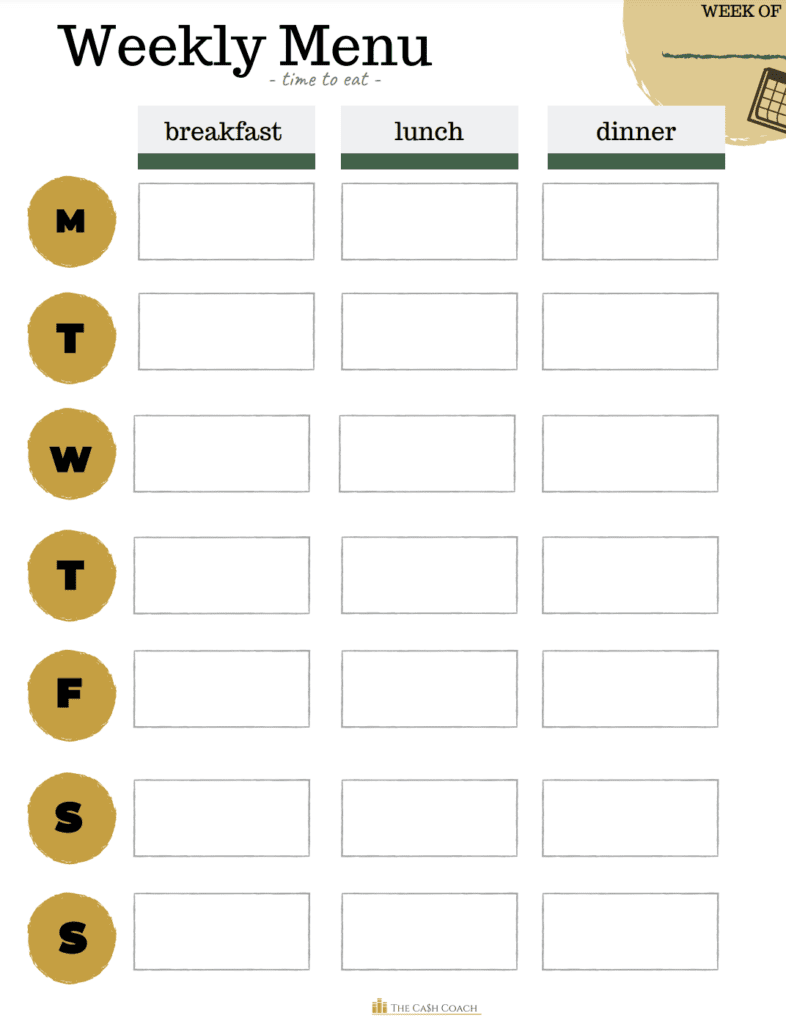

Step 1 – Add meal planning to your weekly routine

First, pick a day when you will sit down to make your weekly meal plan. For me and a lot of others, Sunday works best. Make it part of your weekly chores. Even though this take a little time, I promise this will not only save you money, but also time over the course of the week since you will only have to go to the store one time.

Step 2 – Check the refrigerator

Next week’s meals get their start in your refrigerator, freezer, and pantry. So the next step is to see what needs to be used up, and then think of a meal to make with those items.

Step 3 – Keep it simple

Don’t overcomplicate breakfast and lunch. What three meals can you have for breakfast and lunch?

Step 4 – Use building blocks

Up next is building blocks. Pick two types of protein, one or two grains, and a vegetable medley to make at the beginning of the week and incorporate it into different meals.

For instance, a sauté of broccoli and peppers can be used as a side one night, spooned onto enchiladas another night, and worked into a soup or meatloaf later in the week.

- By the way, this also works really well with recipes you can make in large quantities. If you can make a big pot of something and freeze half for next week, that not only will save you money, but will cut next weeks meal prep time in half.

Step 6 – Schedule a lazy night

We often go to the store hoping to prepare fresh meals all week, but the truth is — we don’t have the time or energy to cook every night. Plan a few lazy nights that don’t require cooking and take the opportunity to order takeout or dine with friends. When you plan it in advance it can feel like a treat instead of a cheat.

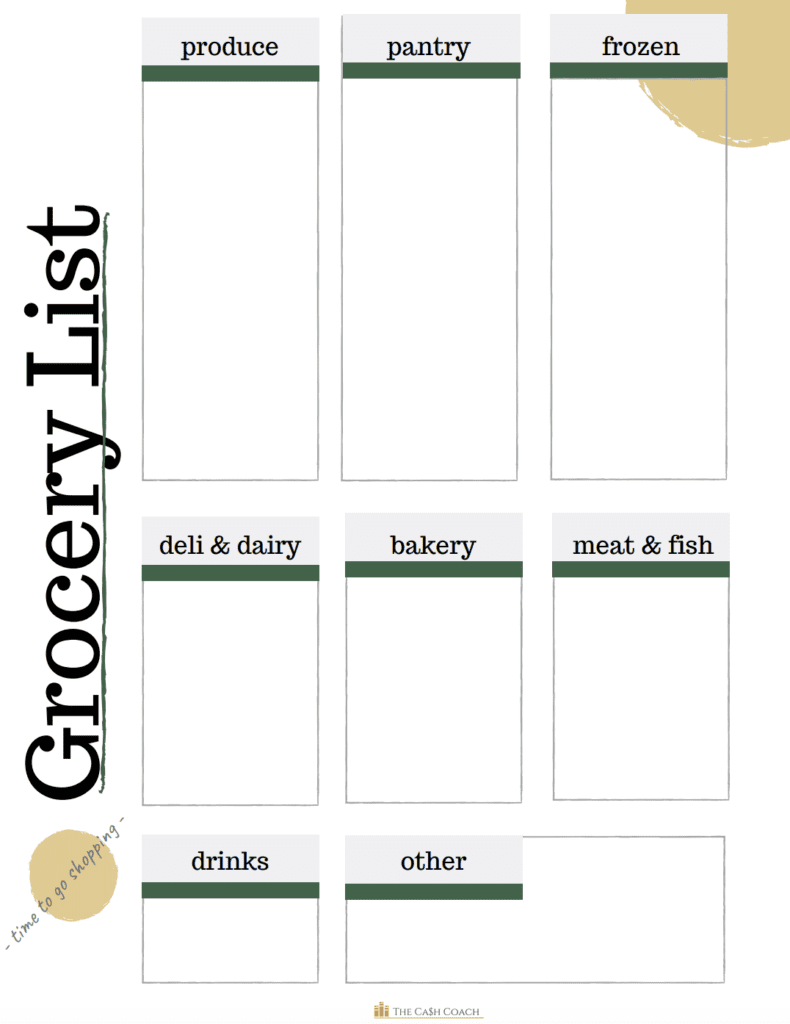

Step 7 – The List

Finally, you’ll want to list out all the ingredients you need to make this weeks meal plan happen and start by shopping online.

Here’s where the magic happens!

One great thing that has come from this pandemic is that online grocery shopping is more affordable than ever. Consider Instacart or something similar to keep you on track and within budget when shopping. It’s a lot easier to start within your budget when you can see things add up online. You can easily compare prices and pick / choose what you want to grab this week vs another week to stay within your budget.

My Challenge To You:

1) Meal plan for the week

2) Shop ONLY once for the week

3) Use online shopping option to help keep you safe and within budget

4) Rinse and repeat

I would love to hear how much you save by meal planning moving forward!

Your BFF (Best Financial Friend),

Coach MicKallyn

Your BFF (Best Financial Friend),

Coach MicKallyn

Meet MicKallyn

Hi, I’m Mickallyn, a Mortgage Lender/Banker turned Financial Coach. When student loans put me in debt, I knew I didn’t want to live the rest of my life paying them off, so I figured out how to pay them all off in just a year. Now I have zero debt, 3 homes, 4 college degrees and am raising two little boys. I’ve traveled to over 22 countries and live a debt free life. I’m committed to helping others do the same through 1 on 1 coaching and personalized plans that actually work.

Follow me on social media for financial planning tips!

5/5