5 Steps to Paying Off Your Debt

80% of Americans are in some kind of debt. Many of my clients are looking for some help to manage their own debt, be it student loans, credit card debt or other personal loans. For many people, paying off debt can feel overwhelming and even impossible. But I am living, breathing proof that you CAN pay off your debt and I promise you will be surprised at how quickly you can do it if you follow the 5 steps below.

Yes, you too, can get out of debt. I see huge progress every day with my clients. It all starts with a strong foundation of support (that’s me!) and a commitment to want to finally be back in control of your financial future (that’s you!)

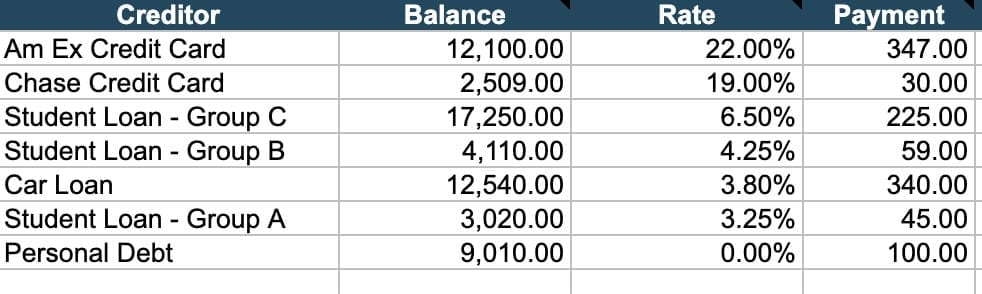

Step 1: Organize

It’s time to confront your debt. If you have never looked at all your debt at one time, this might feel overwhelming or even scary to you, but I promise once you are done, it will be a weight off. Not knowing your exact amount of debt can often be even more stressful! So take the time to gather ALL your debts. Look at every credit card, student loan or medical bill you have. Organize all your debts into a list that includes current balances, associated interest rates, and minimum payments.

Step 2: Strategize

There are two main ways I coach my clients to tackle their debt; snowball or avalanche. Let’s learn about each one so you can figure out which strategy is best for you:

1) Debt Snowball: You focus on paying off your smallest debt first (while paying minimums on the others), then roll the amount you had been paying on it into payments on the next largest. This way you pay off your smallest debts quickly (yay!) and have more money to tackle larger debts.

The Snowball Method is great for those who love instant gratification and need quick wins to stay motivated. It empowers you to stay on track by helping you view your debts as more manageable and less intimidating.

2) Debt Avalanche Method: You pay off your debt with the highest interest rate first (while paying minimums on the others), then the next highest rate, and so on. It may save you time and money throughout your debt payoff. This method is great for people who are motivated to get out of debt and don’t need a quick win but also have one debt that has a significantly higher interstate than others. These high-interest rates cost you extra money each month, so if you eliminate the highest debt first, you even more money to pay off debt each month.

If saving money is the only motivation you need, think about trying out this strategy.

The Snow Ball Method is perfect for people who:

Like seeing early wins to stay motivated

Have large credit card balances

Have low motivation to get out of debt

The Avalanche Method is excellent for people who:

Don’t need quick wins – can see the long game.

Want to focus on the fact that they are saving money with this method.

Have one debt that has a significantly higher interest rate than the rest.

For many people, figuring out which system is best for their personal situation can be tricky. If crunching numbers isn’t your strong suit, or you want another pair of eyes on your debt, schedule a complimentary Discovery Call with me to help determine your best plan of attack.

Step 3: Automate

Automation is the name of the game. Set up automatic payments towards the balance on each account and treat them like any other monthly bill. Automatic payments ensure you will never forget and get charged penalties and late fees. Many accounts will allow you to set a specific date for your payments to auto-pay so you can align them with your paydays.

Step: Focus

Now that we are making minimum payments on all of your accounts, it’s time to focus on ONE account at a time. In this step, you put all your extra cash toward making additional principal payments on the one loan you are focusing on (either your smallest or the highest interest as we determined above). Each time an account is paid in full, redirect those “payment funds” to the balance with the next highest interest rate.

For example, if you determine that the Snowball Method is the best for you, you would be making payments towards your smallest debt first. Let’s say it’s 1K. If the minimum payment is $50, you will add your additional $200 towards this debt each month, making your monthly payments $250. After 4 months, when your 1K debt is paid off, take that $250 you are now used to paying each month and roll it over into making payments on your next debt. If your next debt is 10K and your minimum payment is $500 a month, you add the $250 from the first debt now making your monthly payments $750.

See how much faster you can pay off your debt when you snowball payments?

Step 5: Plan

If you don’t have a financial plan in place, you could easily fall into old spending habits and undo all the hard work you’ve been putting into paying off your debts. Financial coaches are specially trained to help you address spending behaviors, identify pitfalls and potential traps so that you can not only get out of debt but stay out of it for good. Here’s a few things I go over with my clients who are looking to get out of debt:

Do you know your numbers? What does your cash flow look like? What is your GAP between your income and expenses? You need clarity and a system to understand both your recurring and day-to-day spending.

Do you know the date you will be out of debt? Calculate the date you plan to no longer be in the red! (By the way, I can give a ton of clarity on this when we do your Power Plan Session). Publish these dates somewhere you see them daily as they are incredibly motivating!

I’ll leave you with this: if you are making headway on getting out of debt, you are doing it right. Choose a strategy that gets you excited and stick with it! Don’t change in the middle because of someone else’s recommendation. Stay the course!

If you find trouble executing the above steps, reach out to me. Let’s talk about your debt strategy in our initial consultation. I’ve helped many clients flip their net worth from the negative to the positive. If you are ready to get serious about your money, I’m here to help.

If you are ready to get accountable, I’m ready to help you achieve your goals! Let’s connect to talk about your goals.

Meet MicKallyn

Hi, I’m Mickallyn, a Mortgage Lender/Banker turned Financial Coach. When student loans put me in debt, I knew I didn’t want to live the rest of my life paying them off, so I figured out how to pay them all off in just a year. Now I have zero debt, 3 homes, 4 college degrees and am raising two little boys. I’ve traveled to over 22 countries and live a debt free life. I’m committed to helping others do the same through 1 on 1 coaching and personalized plans that actually work.