Have you heard of Ally’s Savings Buckets or virtual money buckets?

If not, you are in for a treat!

Ally’s Savings Buckets are a way to organize and optimize your money within one savings account. This feature allows you to split up your savings into different categories and personalize your saving goal by naming them.

This is one of my favorite tools to share with my clients because your motivation increases exponentially when you visualize your savings goals. Personalizing your savings goals by name = you save more!

From ‘Wedding Gown’ to ‘Home Down Payment,’ digital Buckets help people stay focused on the things that matter most to them.

Here are 5 ways you can use Savings Buckets to take the stress out of your finances:

1.To plan for life’s expected and unexpected expenses:

- You can’t control when life will happen, but you can control how you feel it financially.

- Auto Expenses

- Saving up for new tires

- Unexpected car repair

- Home Repair

- Surprise plumbing leak

- Saving for a bathroom remodel project

- Pet/Vet

- Emergency surgery

- Regular vet exam costs

- Auto Expenses

- You can’t control when life will happen, but you can control how you feel it financially.

2. To set and track specific goals:

- Set up a bucket to clearly see your goal without commingling it with other saving goals. It’s much more exciting to tuck away $25 here and there when you can direct it towards a specific purpose.

- Peleton

- Wedding gown

- Furniture

- Set up a bucket to clearly see your goal without commingling it with other saving goals. It’s much more exciting to tuck away $25 here and there when you can direct it towards a specific purpose.

3. To stop feeling guilty:

- Budget for things you value or make you feel good. This is great for those who might have a scarcity mindset and have a hard time spending on special events.

- Botox or Personal Grooming Account

- Travel and Entertainment

- Concerts

- Girls weekend

- Ski passes

- Budget for things you value or make you feel good. This is great for those who might have a scarcity mindset and have a hard time spending on special events.

4. To give yourself a budget:

- Do you find yourself overspending on specific categories? Set-up monthly contributions and give yourself an easy to manage budget when the time comes. Tuck away $25 a month and you’ll have a healthy Christmas Fund to use at the end of the year. Some other area’s this works well for:

- Gifts (birthdays, engagements, etc.)

- Shopping

- Hobbies

- Do you find yourself overspending on specific categories? Set-up monthly contributions and give yourself an easy to manage budget when the time comes. Tuck away $25 a month and you’ll have a healthy Christmas Fund to use at the end of the year. Some other area’s this works well for:

5. To save for large and annual expenses:

- Do annual expenses catch you by surprise? It can be a bummer when your budget is totally on track and then you get that car registration in the mail. To counteract this, break down these yearly expenses into monthly “bills” and transfer that amount to your ally account for that area. Examples of annual costs might be:

- Car registration renewal

- Car insurance

- Amazon renewal

- Subscription renewal

- Do annual expenses catch you by surprise? It can be a bummer when your budget is totally on track and then you get that car registration in the mail. To counteract this, break down these yearly expenses into monthly “bills” and transfer that amount to your ally account for that area. Examples of annual costs might be:

FYI: This also works for big ticket goals you are working towards. You can reverse engineer your savings plan to hit these goals.

- Down Payment on a house or car

- IVF

- Vacation

Read more about how to reverse engineer your goals HERE.

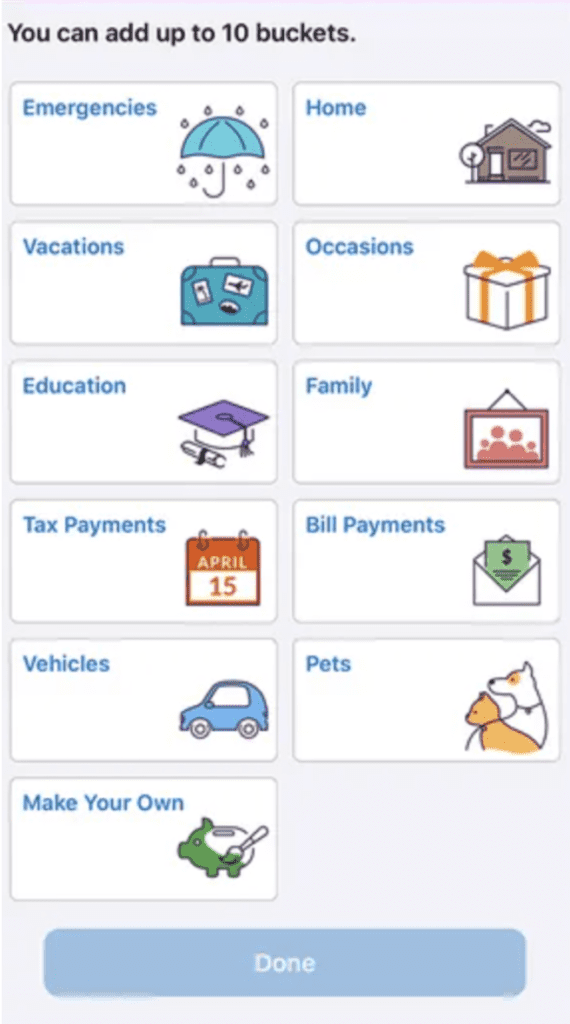

The best part about savings buckets is you no longer need multiple bank accounts, envelopes, etc.… Ally gives you the option to create up to 10 different buckets within one savings account. Each bucket can be assigned a different goal or purpose. Hello, organization!

This is hands down my client’s favorite tool that I teach them. In fact, 100% of my clients report back that they use and love this system. I went over the basics here but a Power Plan session can help us dig deeper into how exactly to set up these accounts to improve your personal cash flow & savings strategy.

If you already use savings buckets, drop me a comment and let me know what you are using it to save for!

Meet MicKallyn

Hi, I’m Mickallyn, a Mortgage Lender/Banker turned Financial Coach. When student loans put me in debt, I knew I didn’t want to live the rest of my life paying them off, so I figured out how to pay them all off in just a year. Now I have zero debt, 3 homes, 4 college degrees and am raising two little boys. I’ve traveled to over 22 countries and live a debt free life. I’m committed to helping others do the same through 1 on 1 coaching and personalized plans that actually work.